Recognizing that responding to climate change is an important management issue, the Nitto Group has strategically included such responses in its management agenda and announced its support for the recommendations by the Task Force on Climate-related Financial Disclosures (TCFD) in May 2022. After announcing our support, every year, we assess the impact that climate-change-related risks and opportunities may have on our business and make revisions as necessary. In fiscal 2024, we are refining our governance and risk management systems related to climate change, carefully considering the impacts on our business as we develop our responses.

The Nitto Group has set “Realizing a decarbonized society” as one of its material issues for sustainability and is strengthening its efforts to combat climate change. To solve climate change issues, the Group is working to establish and promote short- to mid-term and long-term strategies by establishing a governance system where President-Director & CEO is appointed as the superintendent, and the Corporate Strategy Meeting plays the central role under the direction and supervision of the Board of Directors.

In addition, in order to increase the effectiveness of climate change initiatives, the Group has established the Global Green Committee led by the officer in charge of promoting climate change-related issues. We strengthen cross-organizational coalitions while examining strategies and implementing and promoting countermeasures against issues. The Nitto Group's governance structure is as follows:

The Nitto Group places environmental, social, and governance (ESG) at the core of its management. As such, rather than establishing a general sustainability committee or ESG committee, we use the Corporate Strategy Meeting, chaired by the President-Director & CEO and comprising of all Vice Presidents, as a platform to discuss the promotion of ESG management. This enables us to incorporate ESG into management in a swift and appropriate manner, and to achieve governance that ensures higher feasibility by integrating the company’s sustainability and growth strategy.

The Board of Directors is responsible for decision-making regarding climate change management policies as well as material matters related to climate change management indicators and targets, such as the mid-term management plan and support for initiatives. Each quarter, it provides periodic directions, and conducts supervision, concerning the climate change targets (future-financial targets) of the mid-term management plan as well as the status of progress toward target achievement, and, as necessary, takes additional steps if a material matter arises.

The Board of Directors is comprised of Directors who possess qualifications, knowledge, and experience related to sustainability, including climate change, and who thus impart it with a sustainable and greater supervision function.

Please see the section below for the skills of each Director.

As for Director remuneration, ESG items (future-financial targets regarded as material issues) have been included in the criteria for performance linked share-based remuneration (additional remuneration as an incentive for improving medium-term performance). Share-based remuneration is granted once every three consecutive business terms. The number of shares to be granted ranges from 10% to 150% and depends on the progress made toward achieving the key performance indicators of consolidated operating income, consolidated ROE, and ESG-related items (future-financial targets laid out in the mid-term management plan).

The Corporate Strategy Meeting, chaired by the President and CEO, is responsible for deliberation and decision-making regarding specific policies and measures for action based on climate change management policies and indicators, as well as managing risks and opportunities and monitoring initiative progress on a monthly basis. It provides periodic reports––on a quarterly basis––to the Board of Directors about the content of its deliberations and decisions and the progress of initiatives, and, as necessary, provides additional reports if a material matter arises. Additionally, to ensure that the matters deliberated and decided are promptly disseminated throughout the company, the Corporate Strategy Meeting comprises all Vice Presidents who are in charge of business execution departments, special function departments, and regional management.

We appoint an officer in charge of promoting climate change initiatives, and also have a special function department responsible for implementing those initiatives that serves as a department in charge of the environment.

In order to enhance the feasibility of climate change initiatives, we have established the Global Green Committee that is managed by the officer in charge of promoting climate change initiatives, aiming to strengthen cross-organizational cooperation among the various functional departments involved, including departments promoting ESG management in general, procurement departments, business execution departments, and regional management. The major activities of the Global Green Committee are as follows:

The Global Green Committee reviews climate change strategies (including transition plans), as well as executing and promoting measures to tackle climate change challenges. The initiatives of the Global Green Committee are periodically reported to the Corporate Strategy Meeting primarily by the department in charge of the environment.

The Group appropriately manages key risks and opportunities related to climate change that management recognizes may significantly impact its business activities and implements comprehensive management across the Group by combining them with other key risks that also significantly impact its business activities.

Regarding key risks and opportunities related to climate change, the Group understands the impact of changes in the internal and external environment; evaluates and selects (identifies) relative importance based on the “magnitude of impact” on business in the case of an incident and the “possibility of occurrence,” which actually occurs; and determines the priority of the risks and opportunities.

To identify risks and opportunities, we utilize scenario analysis to identify the risks and opportunities associated with the shift to a low-carbon economy that are expected due to climate change, as well as the risks of physical damage posed by factors such as extreme weather, for not only Nitto but the entire value chain stretching from our suppliers to customers, and then make a qualitative and quantitative assessment of the possible financial impacts.

The Nitto Group appropriately manages the selected major risks and opportunities associated with climate change under the Risk Management Promotion system below.

The key risks and opportunities related to climate change will be monitored by business execution departments and regional managers in collaboration, while the department responsible for environmental issues will assume responsibility for managing them. Information regarding monitored risks and opportunities, together with information managed by other special function departments, will be reported and deliberated monthly at the Corporate Strategy Meeting, which consists of Directors and Vice Presidents. The results of the deliberation will be instantly communicated to related departments, and countermeasures against risks and measures for opportunities will be promptly taken to strengthen controls. The progress of the implementation and improvement will be again reported to and monitored at the Corporate Strategy Meeting to increase the effectiveness of the Group management.

At the end of the fiscal year, the department in charge of the environment, as the department responsible for management, conducts a self-evaluation on the major risks and opportunities associated with climate change that were reported and reviewed in the Corporate Strategy Meeting in accordance with evaluation criteria such as the implementation structure establishment, controls and preventative measures implementation, and the occurrence of incidents as well as the responses to them. The department in charge of risk management evaluates the results of the self-evaluation from an independent viewpoint. Once this is approved by the officer in charge of risk management, it is reported to the Corporate Strategy Meeting and the Board of Directors as an independent evaluation.

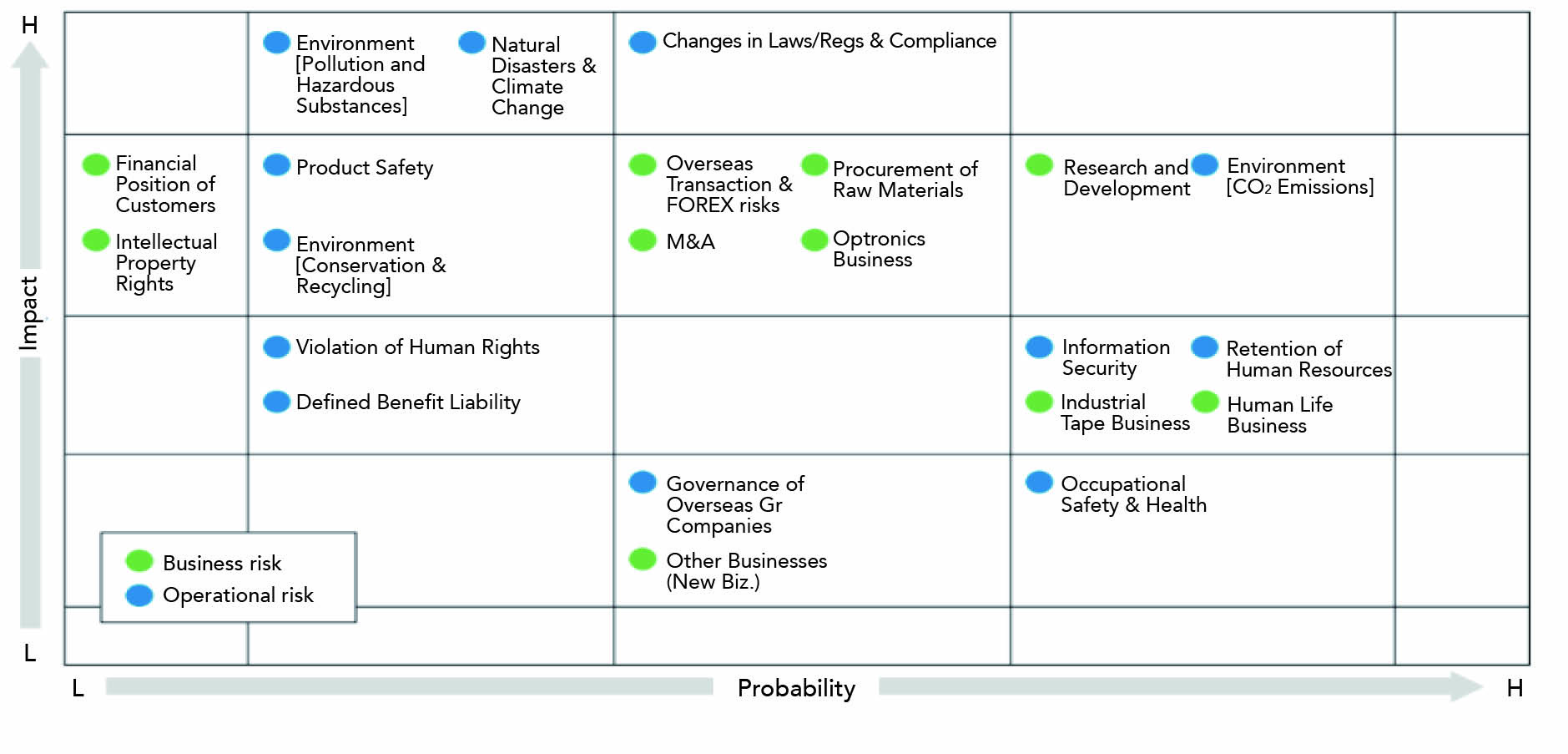

As a group, we manage risks and opportunities related to climate change comprehensively by integrating them with other major risks that significantly impact our business operations. We assess the relative importance of individual risks by analyzing them using a graph with two axes––a vertical axis representing the “degree of impact” on our business in case of occurrence or manifestation, and a horizontal axis representing the “probability of occurrence”––and recognize the significance of climate change risks among group-wide risks. We categorize these group-wide risks into “business risks,” which are associated with our businesses, and “operational risks,” which can generate group-wide impact, and implement appropriate risk management on a group basis. The major group-wide risks in fiscal 2023 are as follows. Please see here for more details.

In line with external trends, as exemplified by the conclusion of the 2015 Paris Agreement and the Japanese government’s carbon-neutral declaration, the Group carried out a scenario analysis regarding transition risks and physical risks and opportunities expected due to climate change across the entire value chain, which includes not only the Group but also its suppliers and customers. The results of the scenario analysis have been incorporated into 2030 management indicators, including Nitto Group Carbon Neutral 2050, and into the mid-term management plan Nitto for Everyone 2025, confirming the effectiveness of the strategy. Meanwhile, the Group has revised its CO2 emission target from 470,000 to 400,000 tons based on scientific grounds, making it a higher target commensurate with 1.5°C. To achieve the target, the Group will promote initiatives to remove solvents, save energy, use renewable energy, and create products that contribute to the environment, thereby minimizing risks and maximizing opportunities.

To realize a decarbonized society, the Group recognizes measures against climate change as its material management issue and strategically incorporates them into its management.

Please see here for Nitto Group Carbon Neutral 2050.

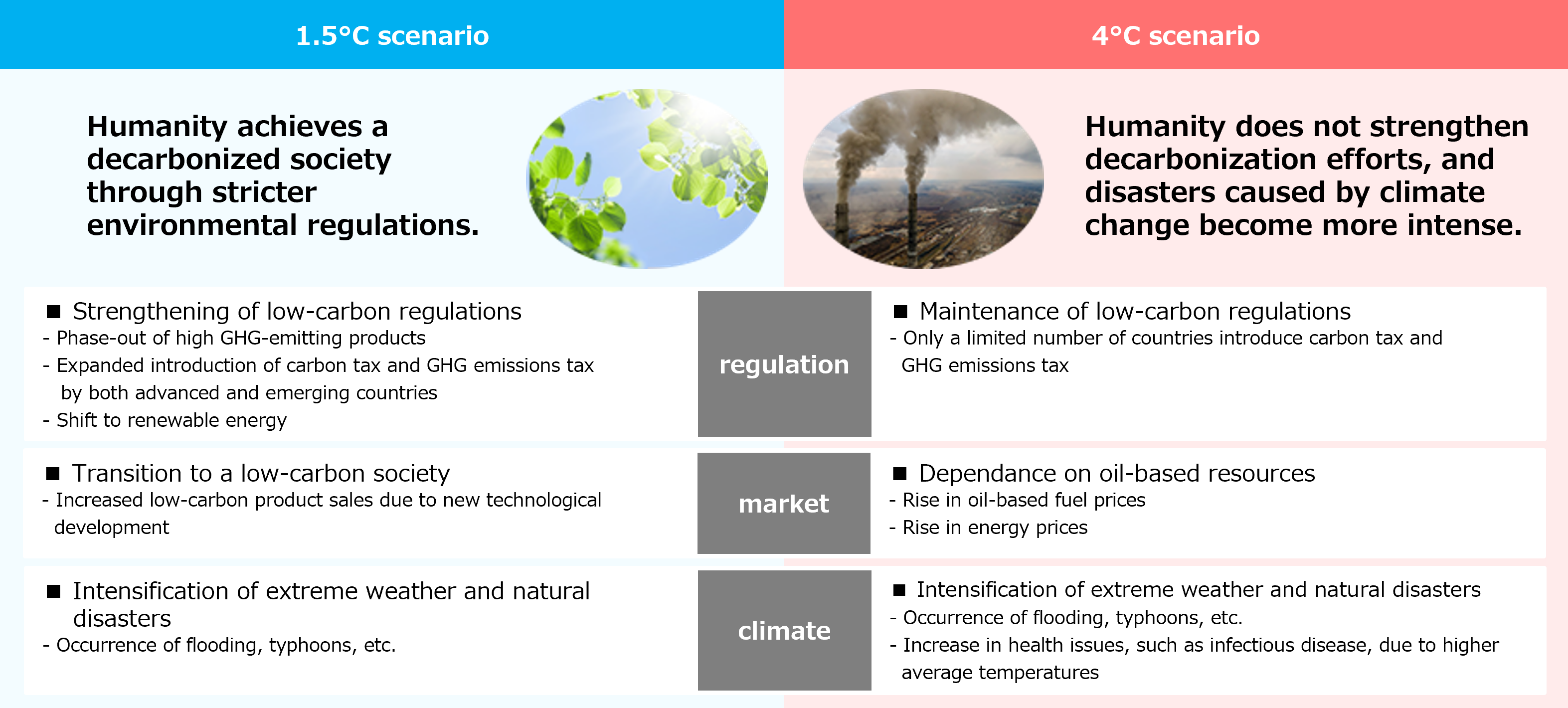

We forecast the impact that changes in the business environment caused by climate change may have on our businesses and management, and then create scenarios based on this. We consider the “1.5°C scenario,” under which the average global temperature does not exceed that of preindustrial times by more than 1.5°C by 2050, and the “4°C scenario,” under which the average global temperature is likely to exceed that of preindustrial times by 3.2 to 5.4°C by 2050.

These scenarios are created based on information published by the international organizations indicated below. The business environment assumed in each scenario is as follows.

We identify the risks and opportunities in the short term (less than three years), medium term (three to six years), and long term (six years or more) under the business environment assumed in the respective scenarios. The short-term and medium-term risks and opportunities are reflected in the mid-term management plan. For the long-term risks and opportunities, we conduct a financial quantitative analysis to identify the business impact (financial impact) in the event that the respective scenarios materialize. The business impacts in the long term is as follows.

| Type of risk/opportunity | Event | Assumed risks and opportunities | Impact calculation item | 1.5℃ | 4℃ | |||

|---|---|---|---|---|---|---|---|---|

| 2030 | 2050 | 2030 | 2050 | |||||

| Transition risks | Policy and laws and regulations | Strengthening of low carbon regulations | An increase in transition costs (raw material costs) to low GHG-emitting raw materials | Increased costs for switching to sustainable raw materials | Large | Large | ー | ー |

| A substantial increase in renewable energy procurement costs due to the spread of renewable energy | Increased costs for renewable energy procurement | Small | Small | ー | ー | |||

| An increase in capital expenditure (installation costs of renewable energy facilities) due to the spread of renewable energy | Increased capital investment costs due to introduction of renewable energy facilities | Small | Small | ー | ー | |||

| An increase in waste disposal costs due to stricter waste disposal regulations and standards. | (Quantification planned if the impact of waste disposal costs becomes measurable) | |||||||

| An increase in GHG emission price | An increase in taxation costs (operating costs) due to the increased introduction of carbon taxes and GHG emission levies | Increased operating costs due to increased tax obligations | Large | Large | Small | Medium | ||

| Technology | Transition to low carbon products due to investment in new technologies | A substantial increase in capital expenditures (installation costs of high-efficiency facilities) due to the development and introduction of high energy-efficient technologies | Increased capital investment costs due to introduction of high-efficiency facilities | Medium | Large | ー | ー | |

| Industry/market | A substantial increase in raw material prices | An increase in petroleum-derived raw materials procurement costs due to soaring fossil fuel prices | Increased procurement costs due to higher oil-based raw material prices | Medium | Large | Large | Large | |

| An increase in petroleum-derived raw material costs due to carbon taxes and other taxes in the upstream of the value chain passed on to raw materials | ||||||||

| Increase in transport costs due to higher fossil fuel prices. | (Quantification planned if the transport costs become identifiable) | |||||||

| An increase in energy prices due to soaring fossil fuel prices | Increased energy costs associated with fossil fuel prices | ー | ー | Medium | Medium | |||

| Physical risks | Acuteness | Occurrence of abnormal weather and natural disaster (acute) | Damage to the company’s buildings, facilities, infrastructure, etc., plant shutdowns, and lost opportunities (decrease in revenue) due to a flood, high tide, etc. | Damage to assets due to damage to or suspension of facilities and infrastructure | Medium | Medium | Medium | Large |

| Suspension of operation at the company’s plants, loss of opportunities (decrease in revenue) due to major suppliers being hit by a flood, high tide, etc. | Opportunity loss due to damage to or suspension of facilities and infrastructure | Small | Small | Small | Small | |||

| Chronic | Sea level rise | Suspension of Nitto plants due to flooding, etc. | (No relevant Nitto plants) | |||||

| Opportunities | Products/services | An increase in demand for low-carbon products(Change in preferences) | An increase in revenue of products contributing to the environment due to increased demand for recycled products | Increased sales from products contributing to the environment | Medium | Large | ー | ー |

| An increase in demand for medical-related products (response to infectious disease) | An increase in revenue of medical-related products due to an increase in health damage, such as infectious diseases due to rising average temperature | Increased sales from medical-related products | ー | ー | Large | Large | ||

| Monetary impact Small: less than 3 billion yen; Medium: 3 to less than 10 billion yen; Large: 10 billion yen or over.

Those marked with a hyphen are not evaluated as the business impact is expected to be minimal. |

||||||||

Under the 1.5°C scenario, the major factors of profit decline are as follows: increase in transition costs (raw material costs) to low GHG-emitting raw materials, increase in taxation costs (operating costs) due to the increased introduction of carbon taxes and GHG emission levies, and increase in petroleum-derived raw material costs due to carbon taxes and other taxes in the upstream of the value chain passed on to raw materials.

On the other hand, we expect revenue from products contributing to the environment (PlanetFlags products) to increase due to increased demand for recycled products.

Under the 4°C scenario, the major factors of profit decline are as follows: increase in petroleum-derived raw materials procurement costs due to soaring fossil fuel prices, and damage to the company’s buildings, facilities, infrastructure, etc., plant shutdowns, and lost opportunities (decrease in revenue) due to a flood, high tide, etc. On the other hand, we expect revenue from medical-related products, from among our products contributing to human life (HumanFlags products), to increase with the increase of health damage, such as infectious diseases due to rising average temperature.

We have reviewed our responses to risks and opportunities under the respective scenarios.

Under the 1.5°C scenario, we will take the following measures to minimize risk: promote energy saving in the manufacturing process by shifting to solvent-free processes, achieve energy saving by improving infrastructure and utility efficiency, and strive to utilize fully renewable energy. Furthermore, by promoting the development of recycled materials in cooperation with our suppliers, we will reduce the usage of raw materials through the effective procurement of sustainable materials and effective utilization of resources.

These measures will enable the reduction of CO2 emissions, which will in turn enable us to mitigate the increased taxation costs by approximately 50% due to the increased introduction of carbon taxes and GHG emission levies by 2030. Since we expect to have achieved net zero CO2 emissions (Scope1+2) by 2050, we do not believe our costs will increase.

Additionally, as we can reduce our power purchases by energy saving and using renewable energy, we believe it will be possible to mitigate the increase in capital expenditures due to the development and introduction of high energy-efficient technologies by approximately 50% by both 2030 and 2050.

Under the 4°C scenario, we will take the following measures to minimize risk: reduce the usage of raw materials through the effective utilization of resources and develop preemptive prevention measures through the promotion of business continuity management (BCM) across Nitto Group business locations. We believe these measures will enable us to mitigate the increase in petroleum-derived raw materials procurement costs due to soaring fossil fuel prices, as well as the damage to the company’s buildings, facilities, infrastructure, etc., plant shutdowns, and lost opportunities due to a flood, high tide, etc. by both 2030 and 2050.

Under the 1.5°C scenario, we will take the following measures, within the product life cycle, to maximize opportunity: conserve the global and extraterrestrial environment and expand our lineup of products contributing to the environment that offer value to environment conservation (PlanetFlags products). We expect revenue from products contributing to the environment to increase due to increased demand for low-carbon products such as recycled products.

Similarly, under the 4°C scenario, we will work on expanding our lineup of products contributing to human life that offer value to the well-being and to a peaceful lifestyle in a future society of all (HumanFlags products). We expect revenue of medical-related products due to an increase in health damage, such as infectious diseases due to rising average temperatures.We believe we will be able to maintain a certain level of profit by consistently creating PlanetFlags and HumanFlags products.

Please see here for PlanetFlags & HumanFlags.The results of the scenario analysis have been incorporated into 2030 management indicators, including Nitto Group Carbon Neutral 2050, and into the mid-term management plan Nitto for Everyone 2025, confirming the effectiveness of the strategy. Meanwhile, the Group has revised its CO2 emission target from 470 to 400 K tons based on scientific grounds, making it a higher target commensurate with 1.5°C.

Our 80-billion-yen investment for decarbonization over the ten-year period from 2021 to 2030 is being directed primarily to minimize the risks assumed in the 1.5°C scenario: shifting to solvent-free processes, improving infrastructure and utility efficiency, and using renewable energy. Scenario analysis has shown that these measures will enable us to save more than 10 billion yen in costs in 2030 on a single-year basis. Therefore, we believe the expected benefits make it a reasonable investment.

We consider this as validation of the resilience of our strategies for both the 1.5°C scenario and 4°C scenario, and will aim to minimize risks and maximize opportunities even further moving forward.

The Group has set “Realizing a decarbonized society” as one of its material issues for sustainability and believe that reducing CO2 emissions, a cause of global warming, is essential for a sustainable growth and the realization of a sustainable environment and society, and that it is an important social responsibility.

Therefore, the Group ensure that the countermeasures are implemented to minimize risks and maximize opportunities and has established 2030 management indicators and targets to regularly monitor and manage the status of those countermeasures. The main indicators and targets, such as CO2 emissions (Scopes 1+2), waste plastics recycling ratio, sustainable materials procurement ratio, and PlanetFlags and HumanFlags category sales ratio are also set as 2030 management targets and managed by the Group as a whole.

In addition, the Group aims to achieve net zero CO2 emissions (Scope 1+2) by 2050, and has declared the Nitto Group Carbon Neutral 2050.

The indicators and targets for the individual risks and opportunities by 2030 are as follows.

| Type of risk/opportunity | Event | Assumed risks and opportunities | Countermeasures | Indicators and targets | |

|---|---|---|---|---|---|

| Transition risks | Policy and laws and regulations | Strengthening of low carbon regulations | An increase in transition costs (raw material costs) to low GHG-emitting raw materials | Promotion of the development of recycled materials in cooperation with suppliers | (Planned measures) |

| A substantial increase in renewable energy procurement costs due to the spread of renewable energy | Implementation of the Domestic Renewable Energy Procurement Master Plan (stable procurement, including solar power generation system outside the premises)Promotion of PPA procurement | Renewable energy ratio: 100%

(2030: in Japan, 2035: in group-wide) |

|||

| An increase in capital expenditures (installation costs of renewable energy facilities) due to the spread of renewable energy | Introduction/Installation of solar power generation system on the premises (in Japan and abroad) | ||||

| An increase in GHG emission price | An increase in taxation costs (operating costs) due to the increased introduction of carbon taxes and GHG emission levies | Reduction of CO2 emissions (Scope1+2) through promoting use of renewable energy, shifting to solvent-free processes, and improving infrastructure and utility efficiency | CO2 emissions (Scope1+2):400kton(2030) | ||

| Technology | Transition to low carbon products due to investment in new technologies | A substantial increase in capital expenditures (installation costs of high-efficiency facilities) due to the development and introduction of high energy-efficient technologies | Promotion of solvent-free technology (UV, emulsion, hot-melt adhesive) Improvement of infrastructure and utility efficiency | CO2 emissions (Scope1+2):400kton(2030) | |

| Industry/market | A substantial increase in raw material prices | An increase in petroleum-derived raw materials procurement costs due to soaring fossil fuel prices | Effective utilization of resources | Reduction of raw material usage | |

| An increase in petroleum-derived raw material costs due to carbon taxes and other taxes in the upstream of the value chain passed on to raw materials | Effective utilization of resources Promotion of the shift from oil-based raw materials to sustainable materials (bio materials/recycled materials) | Waste plastics recycling ratio:60%(2030)Sustainable materials procurement ratio:30%(2030) | |||

| An increase in energy prices due to soaring fossil fuel prices | Promotion of energy saving, shift to solvent-free processes, electrification, and clean energy (e.g., hydrogen, methane) | (Planned measures) | |||

| Physical risks | Acuteness | Occurrence of abnormal weather and natural disaster (acute) | Damage to the company’s buildings, facilities, infrastructure, etc., plant shutdowns, and lost opportunities (decrease in revenue) due to a flood, high tide, etc. | Promotion of business continuity management (BCM) at an individual Nitto-Group business location level | Continuous implementation of BCM at a group level and an individual business location level |

| Suspension of operation at the company’s plants, loss of opportunities (decrease in revenue) due to major suppliers being hit by a flood, high tide, etc. | Development of a structure for stable procurement of major raw materials Promotion of BCM across major suppliers | (Planned measures) | |||

| Opportunities | Products/services | An increase in demand for low-carbon products(Change in preferences) | An increase in revenue of products contributing to the environment due to increased demand for recycled products | Expansion of the PlanetFlags product lineup | PlanetFlags & HumanFlags category sales ratio: over 50% |

| An increase in demand for medical-related products (response to infectious disease) | An increase in revenue of medical-related products due to an increase in health damage, such as infectious diseases due to rising average temperature | Expansion of the HumanFlags product lineup | PlanetFlags & HumanFlags category sales ratio: over 50% | ||

We enhance the feasibility of the indicators and targets for each risk and opportunity by not only implementing management on a group level, but also by allocating group targets to the business execution departments, setting individual targets for each business execution department, and developing business-specific measures in addition to group-wide measures. Each business execution department confirms the progress toward target achievement monthly; the department in charge of the environment manages the progress on a group-wide basis and provides a report to the Corporate Strategy Meeting. The indicators and targets are reviewed once a year to make any necessary revisions depending on the progress status or changes in the external environment. The indicators and targets are also reviewed when we update the mid-term management plan once every three years, and revisions are made following review and decision by the Board of Directors.

In fiscal 2023, the Nitto Group’s CO2 emissions (Scope 1 + 2) amounted to 525,000 tons, which is far lower than the target amount of 550,000 tons. This impressive achievement is attributable to greater use of electricity generated from renewable energy sources, as well as ongoing efforts toward energy conservation and deployment of solvent-free solutions at production processes. For these initiatives, we spent approximately 8.6 billion yen in fiscal 2023.

In 2024 and beyond, we will continue our initiatives to promote energy conservation and conversion to renewable energy. Our efforts here include converting products that contain solvents, which require significant energy for drying and recovery, to solvent-free alternatives, and conserving energy by utilizing waste heat and optimizing production control and planning.

We will also attempt to establish technologies for CO2 recovery, among others, by strengthening our efforts to reduce Scope 1 emissions in order to achieve carbon neutrality by 2050 (Scope 1 + 2).

| Indicators | FY2020(Base Year) | FY2021 | FY2022 | FY2023 | FY2025 Target

(medium term) |

FY2030 Target

(long term) |

|---|---|---|---|---|---|---|

| CO2 emissions(Scope1) | ー | 330kton | 299kton | 289kton | ー | ー |

| CO2 emissions(Scope2) | 318kton | 271kton | 236kton | |||

| CO2 emissions(Scope1+2) | 746kton | 649kton | 571kton | 525kton | 550kton | 400kton |

| Per unit of sales(Scope1+2) | ー | 0.76Ton / Million yen | 0.61Ton / Million yen | 0.57Ton / Million yen | ー | ー |

The Nitto Group accurately calculates and reports GHG emissions in accordance with the GHG Protocol in order to identify areas in the supply chain that should be prioritized for reduction. The details of the calculation method for CO2 emissions are as follows.

| Data(Unit) | Calculation method |

|---|---|

| CO2 emissions

Scope1: Direct emissions Scope2: Energy indirect emissions (kton) |

The calculation method is based on emission coefficient of “A Corporate Accounting and Reporting Standard Revised Edition” issued by The Greenhouse Gas Protocol.

The emission factor is shown as below. a ) Energy (fuel, steam): Coefficient stipulated in ”Act on Promotion of Global Warming Countermeasures”b ) Energy (hot water): Emission coefficients for each supplierc ) Energy (electric power): (market) Figures of Japan, Germany and part of U.S. indicates emission coefficients by electric power companies, And figures of Vietnam and Taiwan indicates emission coefficients by government. Other areas are calculated by regional coefficients provided by the International Energy Agency’s (IEA) CO2 Emissions from Fuel Combustion, and the United States Environmental Protection Agency’s (EPA) Emissions & Generation Resource Integrated Database (eGRID). (Location) Figures of Japan indicates Japan domestic average, figures of U.S. calculated by the United States EPA eGRID, and other areas are calculated by regional coefficients provided by IEA.d ) Materials burned by Nitto Gr. (solvent): Coefficient decided by Nitto assuming combustion reaction of solvent |

In fiscal 2023, the waste plastics recycling ratio ended up at 47%. This increase is attributed to enhanced internal and external usage driven by improved sorted garbage collection practices. To accelerate recycling, it is important to separate waste plastics into single material units (mono-materials) within the company. To separate products into mono-materials, the Nitto Group is currently working on material recycling technology. A good example is technology for separating tape products into adhesives and base materials. With this technology, we aim to separate and decompose glue adhering to base materials, recycle adhesives back into adhesive materials and convert base materials into resin for use in work clothes, secondary materials, and films.

By establishing these technologies for mass production, we aim to contribute to a circular society as we work on the 2030 targets.

| Indicator | FY2022 | FY2023 | FY2025 Target

(medium term) |

FY2030 Target

(long term) |

|---|---|---|---|---|

| Waste plastics recycling ratio | 46% | 47% | 50% | 60% |

Because of the changes in our product portfolio in fiscal 2023, the sustainable materials procurement ratio ended down at 16%. We will continue to collect highly accurate data on a global basis to promote the conversion of sustainable materials to achieve our fiscal 2025 target of 20%.

| Indicator | FY2022 | FY2023 | FY2025 Target

(medium term) |

FY2030 Target

(long term) |

|---|---|---|---|---|

| Sustainable materials procurement ratio | 17%

non-consolidated |

16%

non-consolidated |

20% | 30% |

In fiscal 2023, the PlanetFlagsa & HumanFlags category sales ratio ended up at 36%. Some of the products certified as such included polarizers with OCA (optically clear adhesive) to streamline customer processes, enhance energy efficiency, and significantly reduce waste. Another key product was thermal conductivity insulation sheets for inverters, which are utilized in energy-efficient heat pump air conditioners to reduce thermal conductivity, thereby minimizing energy loss. The inclusion of these products contributed to a substantial increase in the PlanetFlags & HumanFlags category sales ratio, which rose to 36% from 17% in the previous fiscal year.

As concerns about climate change continue to grow, the development of PlanetFlags products that help address environmental issues is becoming increasingly urgent. For this to happen, we must seek collaboration with partners within and outside the company. Through the avenue of the Global Green Committee, which facilitates the decarbonization and resource recycling processes by way of technological changes, we will create new PlanetFlags products with the three axes of business divisions, regional headquarters, and functional departments cooperating organically. At the same time, we will work closely with business partners and suppliers to take diverse measures to accelerate the commercialization process, including gaining a stake in startups and venture businesses.

| Indicator | FY2022 | FY2023 | FY2025 Target

(medium term) |

FY2030 Target

(long term) |

|---|---|---|---|---|

| PlanetFlags & HumanFlags

category sales ratio |

17% | 36% | 40% | over 50% |

Please see here for past data on our Scope 1, 2, and 3 emissions and other individual key management indicators.

The Nitto Group has implemented environmental investment based on internal carbon pricing (ICP) in order to ensure achievement of the 2030 Management Targets (CO2 emissions) committed in Nitto Group Carbon Neutral 2050. We are promoting investment, primarily in new environmental technology and facilities, at an assumed internal carbon price of 10,000 yen/t-CO2, based on consideration of EU-ETS and other external trends.